Perhaps you’re looking for money saving tips to get to your first $10,000 (or more!) or just want some ideas on how to work on your money management. Whatever your financial goal, these are some of the best money saving charts from around the internet to get you on track to achieve it.

Not only are they good for setting out some financial concepts in a super simple way, but they can be a great reminder of just what steps you need to follow to get your finances under control.

So to make sure they’re always at hand, grab your favorite saving money chart and either pin it to Pinterest, save it as a PDF – or it could even make a great printable for your fridge door!

Money saving charts

1. Financial lessons from the last recession (that you should put in place now)

The Great Recession of 2007 to 2009 was, to put it mildly, a really difficult time for many people. But many experts are forecasting a similar situation in the coming year or so, especially as we come out of the events of the last few years.

Fortunately, there are lessons we can take from previous recessions that, if you put them in place, will go a long way to helping to protect your and your family’s finances.

We’ve created this infographic based on survey results showing what people did to get through the recession – and what they wish they’d done. Download it now as you may need it as a reminder over the next couple of years of what you should be focusing on.

2. The 50/30/20 rule of budgeting

We’re huge fans of the 50/30/20 rule of budgeting around here. In fact, I think it’s one of the best ways to structure your budget and your spending to make sure that all your financial needs are being met.

So this money saving chart fits in super well with this by showing you just how the 50/30/20 rule works.

3. Avoid budgeting excuses

I get it – making (and sticking to) a budget isn’t the most fun thing to do in the world.

But if you’re finding it hard to follow your budget for more than a few weeks – let alone start one altogether – it’s time to sit yourself down and really ask yourself why.

Especially when it’s clear that the reasons for why you should save money – that being the massive potential benefit to your finances – are clear!

So check out this money saving chart that looks at why you might be failing at budgeting – and exactly how to fix that.

4. How to budget

Maybe starting a monthly budget isn’t for you. You could be paid at different intervals or your spending doesn’t quite align with that period.

Either way, if that doesn’t fit your circumstances, that doesn’t mean you shouldn’t have a budget at all, as you can definitely still live on a budget!

So this money saving chart will show you just how to start a budget no matter how your money goes in and out.

5. Save money on groceries

This money saving chart has some great tips for saving money on your grocery shopping, with food savings offering a serious opportunity to drastically cut your expenses.

Not only does it mention using an app, like Swagbucks, to save money on food, it also mentions my other favorite tip: meal planning.

While I try to do this every week, it can definitely be a struggle to think of new things to cook each week.

So in my case, I like to make things easier on myself by having the meal plans sent directly to me.

For that, I use a service called $5 Meal Plan. It costs, surprise surprise, $5 per month – meaning that for only $1.25 per week, they send me meal plans, recipes and shopping lists.

I can’t stress this enough: the amount of money AND time I’ve saved is worth way more than $1.25 per week. And better yet, the recipes only cost about $2 per person to make, so my wallet’s even happier about it.

Take a look by signing up for $5 Meal Plan here for a 14-day free trial!

6. Save on your shopping

Another great tip for saving money on your shopping is to buy seasonally.

And that doesn’t apply only to food! Take a look at this money saving chart to see how buying almost anything at certain times of the year can save you a ton.

7. More grocery shopping tips

Here’s another great money saving chart packed full of grocery shopping tips.

One of the ideas it mentions that the earlier one didn’t is to always shop with a list.

This is one of the most important things I do to save on our groceries, as it means you’re only buying what you need AND you’re avoiding forgetting something, forcing you to go back to the supermarket and potentially spend more.

8. Ways to save money

Sometimes we just need some money saving tips to show us how saving more money can actually be really easy (including if you want to save $5,000 in six months).

In fact, there are probably a ton of areas in your life where you could cut back your spending that you haven’t even thought of.

So this super simple money saving chart will give you some great ideas on where you could start to save more.

9. How saving small amounts can add up

The best thing you can do for cutting back your spending is to focus on your big expenses.

For example, you’re going to save a lot more money on rent or your mortgage if you choose to live somewhere that’s no bigger than what you need, compared to the savings if you stop buying your daily coffee.

(Yes, that’s right, we’re pro-lattes here. No one bought a house on $4 a day, after all.)

But that doesn’t mean you shouldn’t try to save on smaller expenses too as they can really add up. In fact, that’s exactly why the 100 envelope challenge is so effective.

To see how, for example, some savings around the house can add up to around $8,800, check out this money saving chart.

10. Simple money saving chart

This is another great, easy-to-use money saving chart that does just what it says on the box: gives you simple, doable money saving tips.

And the graph down the bottom shows just what you could be doing by simply plugging your numbers into Excel! It also shows that it’s fine if your spending doesn’t go straight down immediately (like if you have a bit of a blip like this person did in March) as long as your expenses decrease in the end – and stay down.

11. Saving mistakes to avoid

Not all attempts at saving are good for you – in fact, some can actually cost you more in the long run.

So this money saving chart will show you the things you definitely want to avoid if you’re working at saving more.

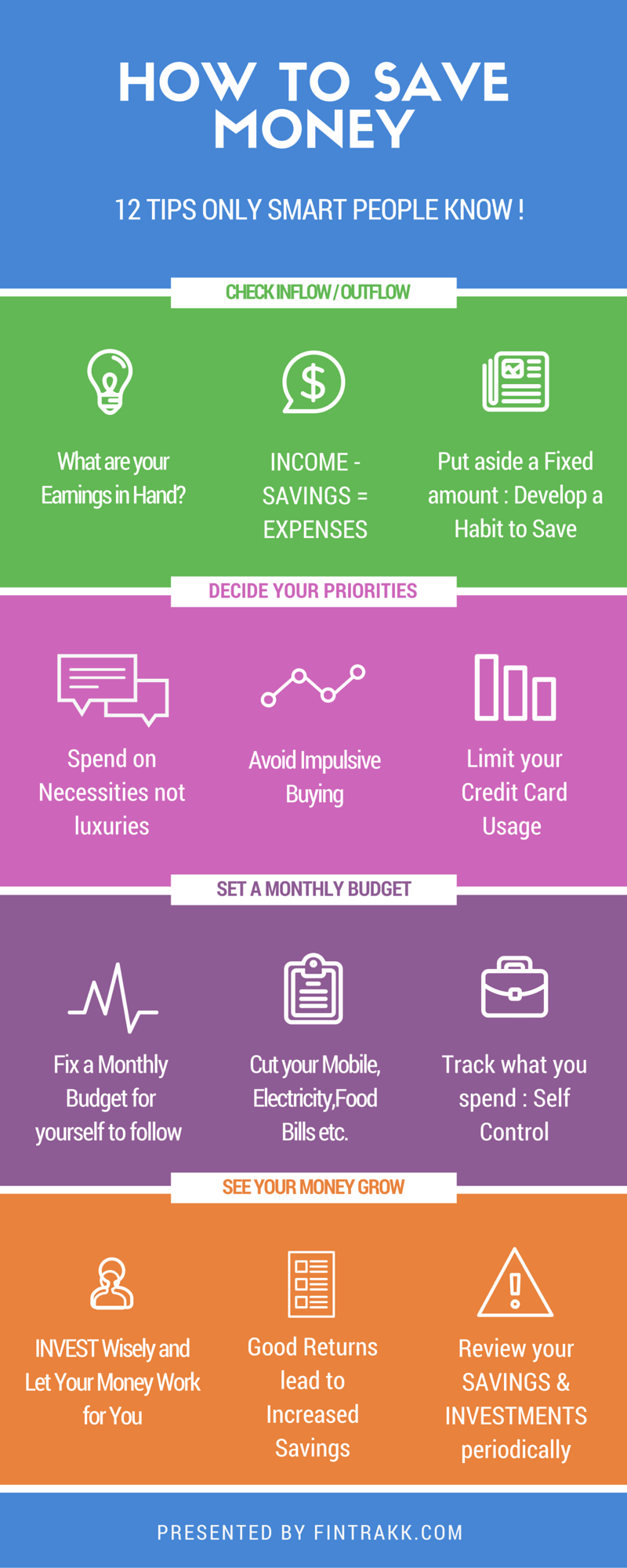

12. Smart money saving tips

The book The Millionaire Next Door involved the author interviewing a bunch of millionaires in the US to find out how they got to where they were financially.

And in the vast majority of cases, it was really very simple: spend within your means and make your money work for you.

They also had a range of other very simple tips that even non-millionaires like you and me can implement in our lives.

Luckily for you, if you can’t be bothered reading that book, this money saving chart is a great visual for many of those tips on how you can save money and live better.

13. Warren Buffet’s investing tips

Warren Buffet is one of the most well-known investors in the world.

With a net worth of around $62 billion, he’s also renowned for making investing accessible to ‘normal people’ like you and me.

So this money saving chart sets out just how he made his fortune – and how he recommends that you do the same.

14. How to retire a millionaire

That’s the dream, isn’t it? To retire (preferably early!) with a seven figure net worth to earn those sweet dividends for the rest of your life.

Fortunately, becoming a millionaire doesn’t actually need to involve winning the lottery. It’s completely doable for everyday people on everyday salaries, if you just follow the tips in this money saving chart.

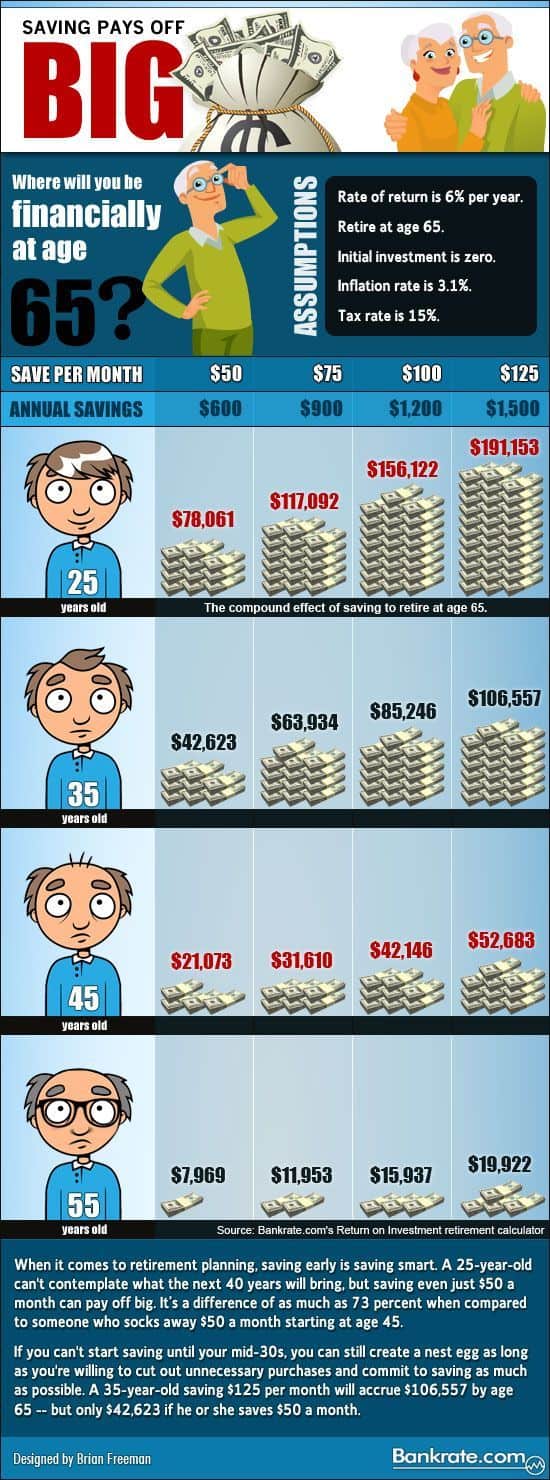

15. How saving even a little bit consistently can pay off

No matter how far (or near) age 65 is for you, it can be helpful to see just how your regular saving and investing habits will pay off once you reach that milestone.

This money saving chart shows just how much your money will be worth even if you’re only saving a relatively small amount each month.

It’s the exact same logic behind being able to save $10,000 in a year – so imagine how the magic of compound interest will work for you if you save even more than this!

16. How much to save each day to become a millionaire

Not sure how the small amounts you’re squirreling away are going to add up over time?

Take a look at this money saving chart then! It shows that, for example, if you’re 30 years old with no savings, you can start saving $14.34 per day (or $436 per month) and be a millionaire by 65!

17. Steps to financial stability

While we can talk for hours about all sorts of financial concepts, at the end of the day they all boil down to a few simple points.

And this money saving chart is a great visual for that. While I’d recommend saving more than the 2%-5% it recommends, the rest is absolutely on point and gives an excellent summary of where you should be focusing your financial efforts.

18. Finance tips for new grads

There are a bunch of ways to save money while you’re a college student.

But when you graduate, that’s when it becomes really important to make sure you manage your money the right way from the word go.

Not only will that immediately put you ahead of everyone else in your cohort, but it’s especially good for ensuring that you start chipping away at student loans immediately without, say, taking on more debt.

So this money saving chart is great for setting out just what new grads should make sure they’re doing from day 1 as a “real adult”.

19. Avoid money mistakes

As people keep showing us time and time again, it’s way too easy to stumble into money mistakes.

So make sure you learn from their errors and don’t do the same!

This money saving chart shows a range of the mistakes that people like to make with their money and what you should do to avoid these, like developing a source of passive income and, yes, making a budget.

20. Money myths you need to forget

There are so many “money rules” we’re told that actually end up being absolute rubbish.

For example, my parents were adamant that buying a house is the only way to be financially secure. But when I ran the numbers, it turned out that renting was far better for me from a financial perspective.

Who would have thought?!

So take a look at this money myth and many more on this money saving chart – who knows, it may just disprove something that you too have been told for your entire life.

21. How to stick to your debt payoff plan

While creating your debt payoff plan is half the battle, it can also be a struggle to stick with it.

So these tips are perfect for making sure you follow your path until its debt-free end.

22. Tips to increase your credit score

Increasing your credit score can save you literally tens of thousands of dollars in the long term due to it allowing you to take advantage of more favorable borrowing rates.

For example, if your credit score is above average, the interest rate on your mortgage will probably be lower, resulting in you saving a ton of money.

It can be hard, though, to know where to get started at improving your credit score.

Well, the first step should be finding out your credit score – after all, you can’t improve it when you don’t know your starting point!

Fortunately, you can check your credit score for free here. And it only takes a couple of minutes!

And for your second step? Well, take a look at this money saving chart for how you can increase your credit score.

23. Become debt free to be financially free

It’s no secret that getting out of debt is one of the keys to financial freedom.

But it can often seem that this is easier said than done.

However, there actually are some pretty basic principles that apply to everyone, no matter what stage of your financial journey you’re at.

Particularly: spend less than you earn.

So this infographic is great for showing you what these steps are – and, hopefully, letting you see that you can definitely apply these tips to your own finances.

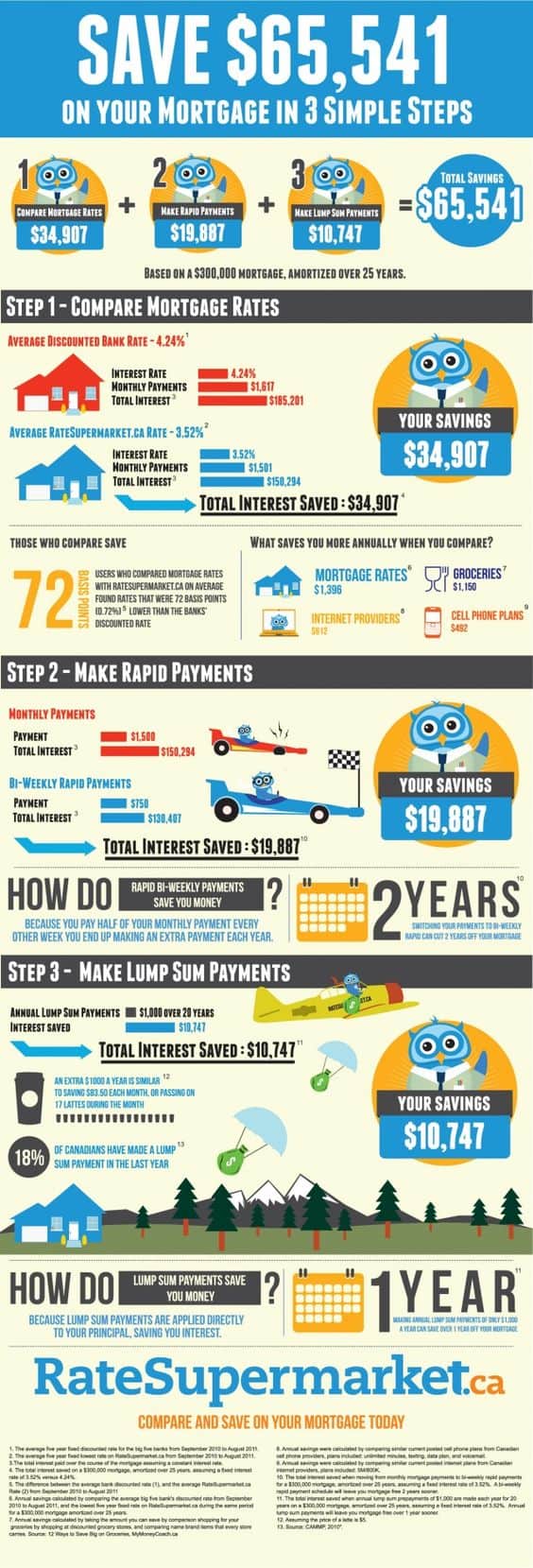

24. Save tens of thousands of dollars on your mortgage

Given that housing costs are often the biggest part of your budget, it can make a HUGE difference to your finances if you work out how to save money on this expense.

So with a bit of math and the magic of compound interest, this money saving chart will show you how you can save a ton on your mortgage.

25. Dave Ramsey’s Baby Steps

If you’ve done any sort of Googling into how to pay off your debt, then you’ve definitely heard of Dave Ramsey.

He’s a guru on getting out of debt although… brace yourself… I don’t actually agree with his strategy.

In a nutshell: he says you should pay off the smallest debt first, as it’s super motivating to get a “quick win”. This is also known as the “snowball method”.

While that’s true, the “avalanche method” for paying off debt – which involves paying off the debt with the highest interest rate first – will actually save you thousands of dollars more in the long run. (Google them both and compare them if you don’t believe me!)

That said, there’s no denying that Dave Ramsey has helped plenty of people get out of debt.

So if that’s the strategy that you think is going to work for you, then take a look at this chart to see what your finance journey might look like!

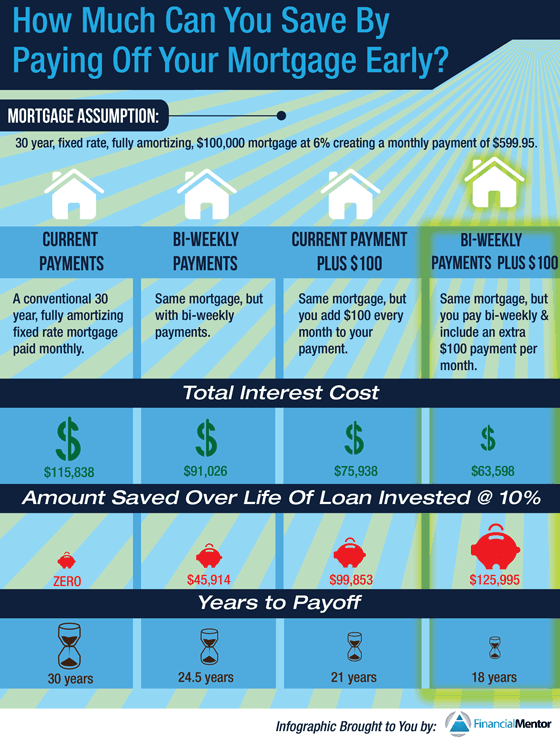

26. See how much you can save by paying off your mortgage early

Did you know that, depending on your mortgage terms, adding only $100 a month to your repayments can save you $39,900 in interest and shorten the payoff time from 30 years to 21 years?

This money saving chart is here to show you how!

And given how many ways there are to earn an extra $100 every day, let alone every month, this is definitely great motivation to push yourself to really focus on getting rid of your mortgage.

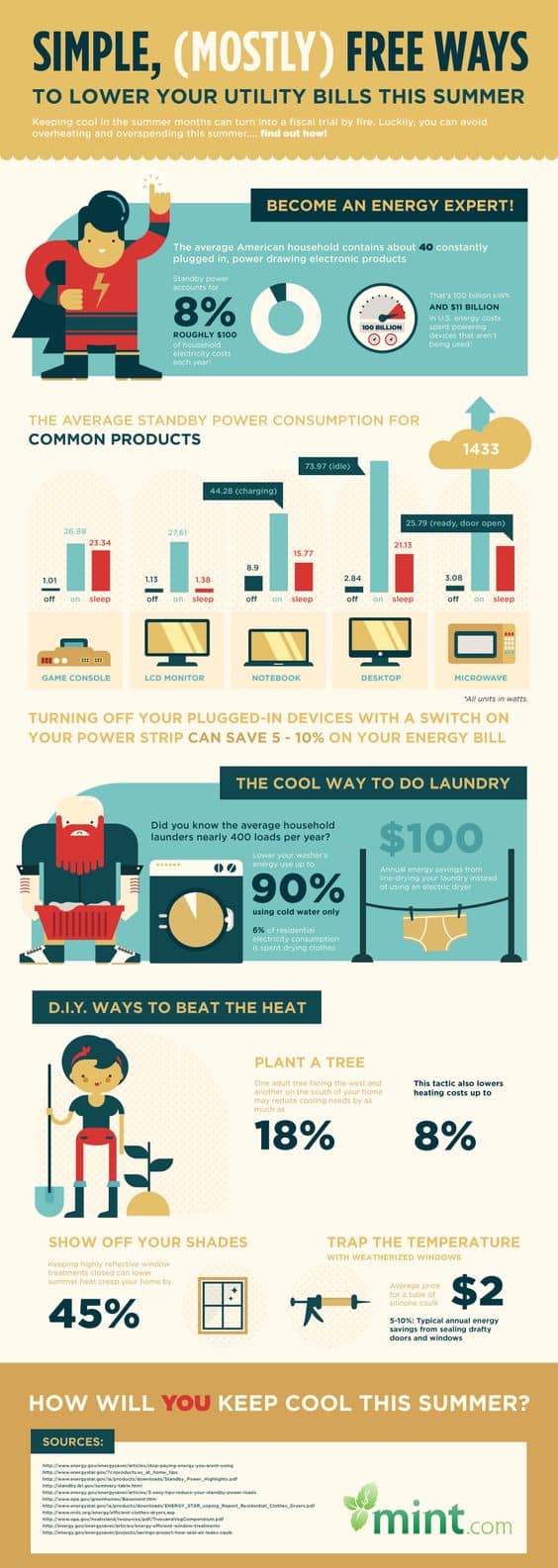

27. How to lower your utility bills

Utility bills represent a huge chunk of most household budgets, so finding ways to cut them back can make a big difference in your personal finances, especially if you’re looking for cheaper ways to live.

This money saving chart shows you ways to do this, but you should also consider trying the totally FREE service offered by Trim.

It’s an amazing app which looks at your recurring subscriptions and finds out just how you can cut back on spending.

For example, it can negotiate your internet and cable bills, find you better car insurance and more – all automatically.

Better yet, it’s totally free to try and, on average, saves users $10 per month on their bills.

To see if you can use Trim to save some money or to give it a try, sign up for a free 14-day trial of Trim here.

28. Make your home more energy and cost efficient

This money saving chart gives some great examples of how being environmentally friendly can also be financially friendly!

I’ve even used many of these tips around my own apartment.

For example, did you know that an LED bulb will save $132 in electricity over the life of the bulb compared to a regular bulb? At the same time, this 12-pack of LED bulbs costs only $3.23 per bulb!

Or that this high efficiency showerhead (that I own!) costs just under $40 but that it will save between $50 to $150 in water costs each year plus around $67 PER PERSON annually in water heating costs?

It definitely pays off – literally – being more energy and resource efficient!

29. Cut your electricity bill

Another day, another great money saving chart with tips on how to cut back on your energy usage – and your spending.

This one mentions unplugging your appliances as a way to do this. However, if you’re like me and you know you’ll probably forget or won’t bother to do that, consider getting a smart power strip.

It doubles as both a surge protector and a nifty little thing that shuts down electronics when it detects that they’ve gone into standby mode.

And it can save you a ton of cash. For example, this article states that experts believe that standby power consumption in an average home ranges from 5% to 10% of your household energy consumption.

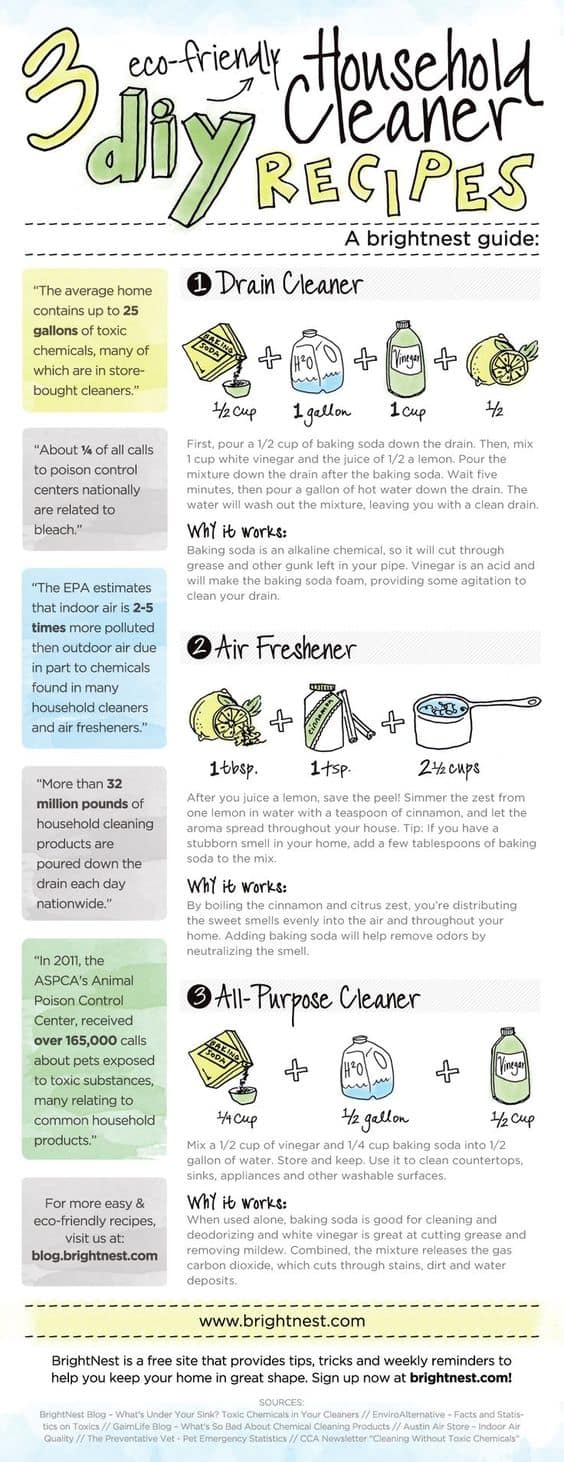

30. Save money on cleaning around the home

Here’s a great money saving tip: you shouldn’t waste money on cleaning products.

Instead, white vinegar can replace pretty much all of your cleaning supplies – and at $4 for half a gallon, you can seriously clean just about everything in your house.

It’s a fabric softener, carpet cleaner, floor polisher, drain cleaner, window washer, oven cleaner and deodoriser – all for next to nothing!

So this money saving chart will show you just how you can use vinegar along with other household items like baking soda and lemon to save a ton of money in replacing pricey cleaning products

31. Buy or rent?

We’re often told that buying a house is a key part of adulting and that owning your own place is the only way you’ll be financially secure.

But the math shows that this actually always isn’t the case.

For example, if you don’t think you’ll be living somewhere for more than five years, it’s generally better to rent so that you don’t pay a small fortune in fees related to buying a property.

Also, going into a significant amount of debt for a mortgage – along with all the other costs involved in owning a house – simply may not work for you.

In both these cases, renting is often the better financial choice in the long run. If you don’t believe me, this rent vs buy calculator from the New York Times will show you the numbers.

In the meanwhile, take a look at this money saving chart for some tips on which option may be best for you.

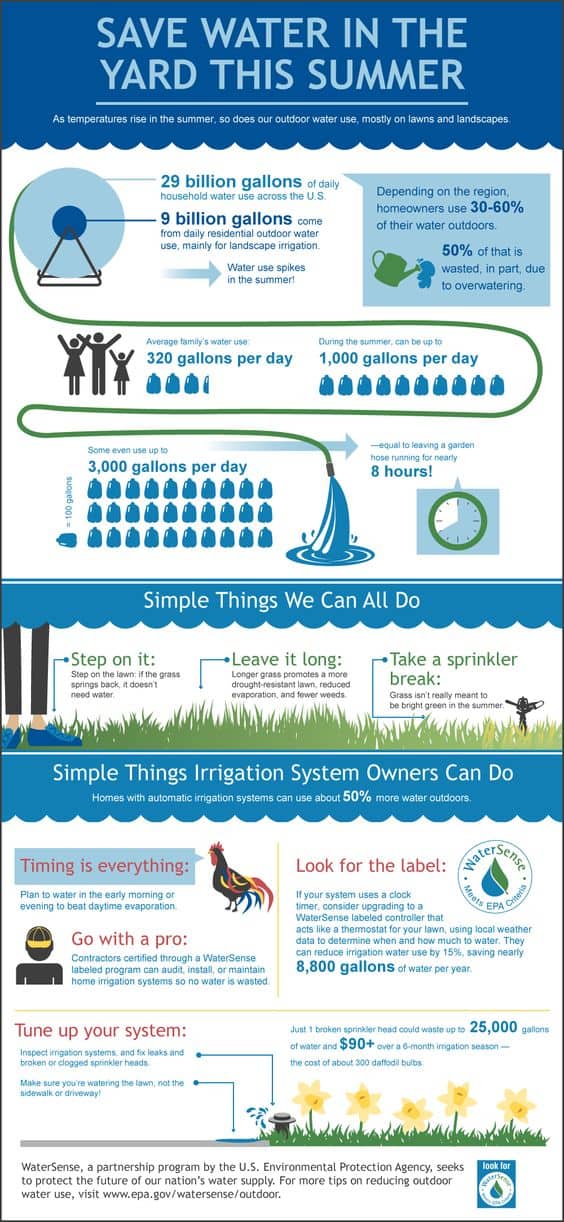

32. Save money in your yard

This money saving chart will show you just how your yard maintenance may be costing you a small fortune in water costs.

So with a few simple tweaks to your watering habits or perhaps by replacing that old leaky hose, check out just how you can save some cash.

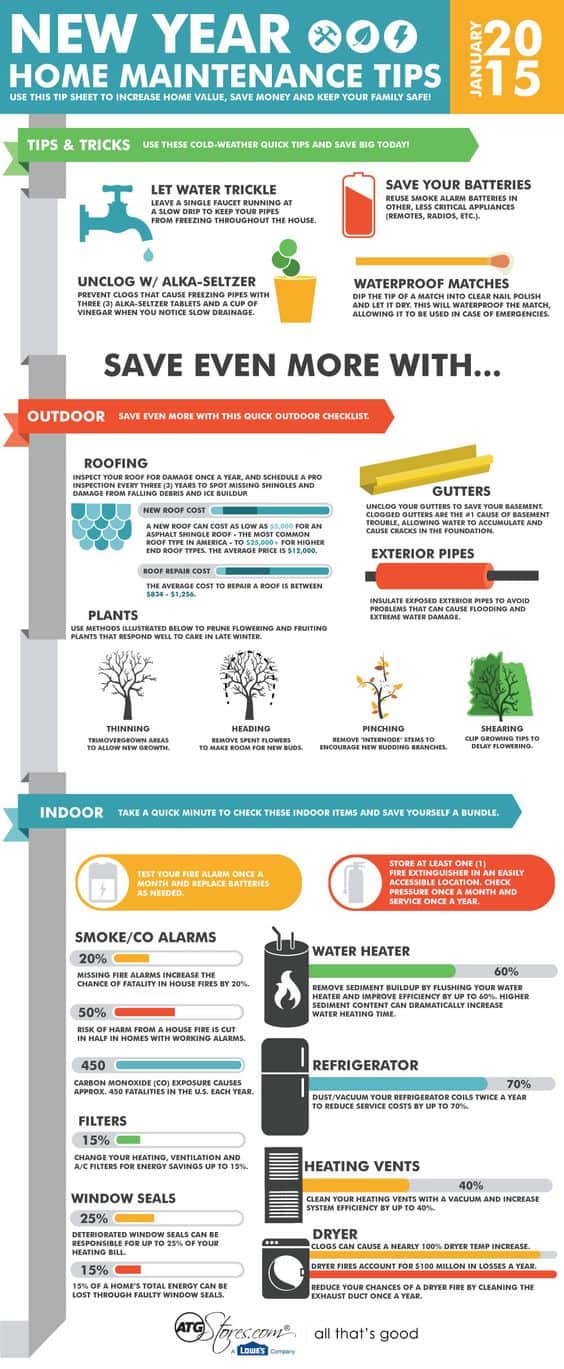

33. Home maintenance money saving tips

So now we’ve seen how to save money on things like your yard maintenance, electricity and cleaning around the home – but what about everything else?

Luckily, this money saving chart covers just about every other area of your home where there may be opportunities to save.

Take a look to get some tips for how you could take a few minutes this weekend to improve your money saving abilities.

34. Save money on water

It’s not only your yard where you can save money on water – what about the rest of your house?

So if your water bills are a bit too high, this money saving chart should give you some new ideas on where you can start to cut back on your water usage (and the cost of this!)

35. The best time to buy a car

Did you know that the time of the year – and even the time of the day – can affect your car price?

Take a look at this money saving chart for how the time of day, week, month and year could save you serious cash on your car purchase.

36. Maximize your gas mileage

The way you drive your car can really affect how much you spend on gas.

Which means just by incorporating a few of these tips into your driving, you’ll be able to save a ton in the long term.

37. Where you can go for $100

$100 in different countries can mean very different things.

From experience, I could last several days on $100 in Sri Lanka.

In Norway, however, I would barely be able to get off the plane for that amount.

So this money saving chart is a great way to immediately see which places are more budget-friendly than others – which is great for starting to budget for an overseas holiday!

38. General travel tips

Sometimes it’s good to just have a reminder on some good, simple ways to save money. They may not be mind-blowing, but they definitely work.

And that’s where this money saving chart comes in!

39. Travel gadgets to save you money

It’s definitely true that some of the “must haves” for travel are absolutely not needed at all.

At the same time, having a couple of these things can save you both time and effort – which can be invaluable when the fun in traveling is being replaced with pure exhaustion.

I don’t agree with everything on this list (I love traveling with my Kindle, for example). But there are definitely some good ideas for what to pack and what can be left behind.

40. Save on accommodation

Where you stay can make a huge difference to your trip – not to mention your budget, given that accommodation costs generally take up a huge chunk of your travel budget.

So take a look at this money saving chart for a range of tips on how you can save on accommodation during your next vacation.

41. Cheapest airline for your needs

If you’ve ever flown anywhere, you’ll know how it’s not just the plane tickets which can eat into your budget.

Instead, it’s those pesky hidden fees for things you didn’t even think of – until you’re presented with a bill at the airport for that bag you could have sworn you were allowed to check in for free.

(Just me?)

Which is why this money saving chart is great as depending on your circumstances, it can show you how you can be strategic with your flight bookings and not throw money away on unnecessary fees.

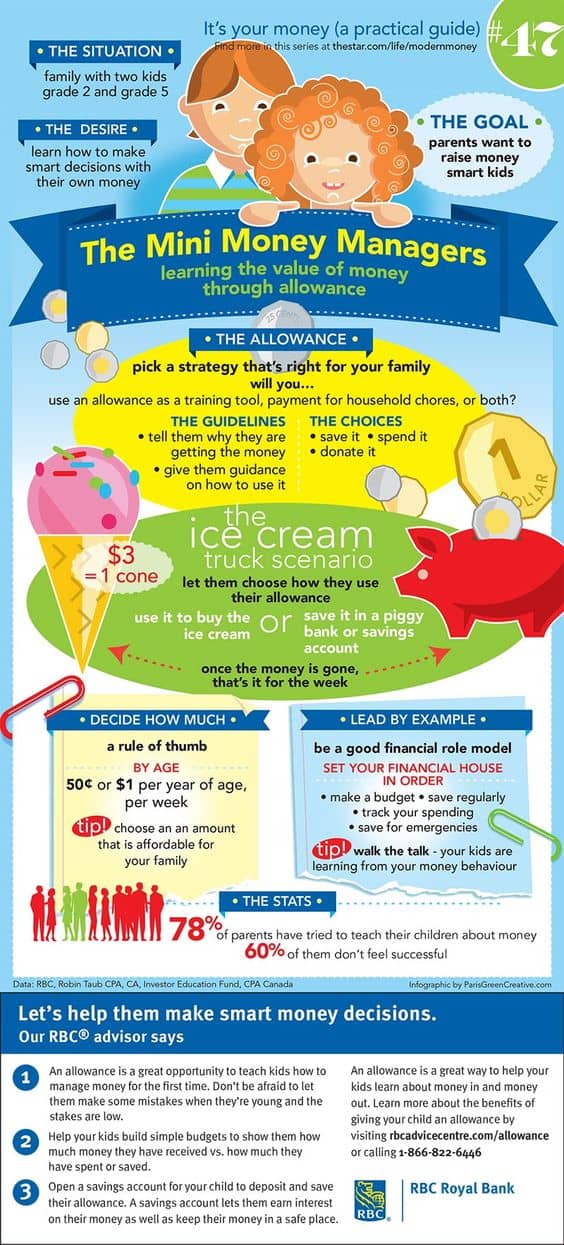

42. Show kids the value of money

This is an excellent money saving chart for capturing a bunch of things you could be doing for teaching your kids about money.

With these simple tips, you’ll easily be able to start showing your children the value of money – which is definitely a habit they can take into the years ahead!

43. How kids are using and learning about money

This money saving chart doesn’t exactly show you how to teach your kids about money, but it does show how kids tend to use money as well as where they are learning about financial issues.

Which can then help you see where you should perhaps address some knowledge gaps in your own kids.

Final thoughts on saving money charts

With all the different topics that these money saving charts relate to, you’ll definitely be able to find one that can help you save money in an area of your life.

They’re especially great for breaking down often complicated issues into an easy-to-read infographic.

Now the next step for you to take is to put them into action!