Welcome to Step 3 of the Step-by-Step Guide to Investing Like a Pro!

First things first: you’ve read the previous Steps right?

- Step 1: The Beginners’ Guide To Investing Like An Expert (Including How To Beat The Professionals)

- Step 2: How To Invest Your Money For The Best Returns (For The Least Amount Of Cost and Effort)

If not, you really need to check those posts out to find out why we recommend index funds as the best way for you to invest your money.

Spoiler alert: they have been shown time and time again to have the best returns. The added bonus is that they are extremely simple, cheap and quick.

However, investing your money isn’t always a consistent march upwards. There are, of course, risks.

And it’s important to keep in mind that there will be times where your portfolio will lose value.

Don’t worry, it will recover. But no one likes to see themselves losing money, even if it is only in the short term.

Fortunately, you can read on for why index funds are still the best performing investment vehicle, even when (yes, not if) there are market crashes.

There are also some tips on how you can deal with a market crash – and even come out richer on the other side!

What’s the risk with index funds?

Great question. Any investment strategy should certainly consider any potential risks, particularly so you can determine if you’re willing to stomach them.

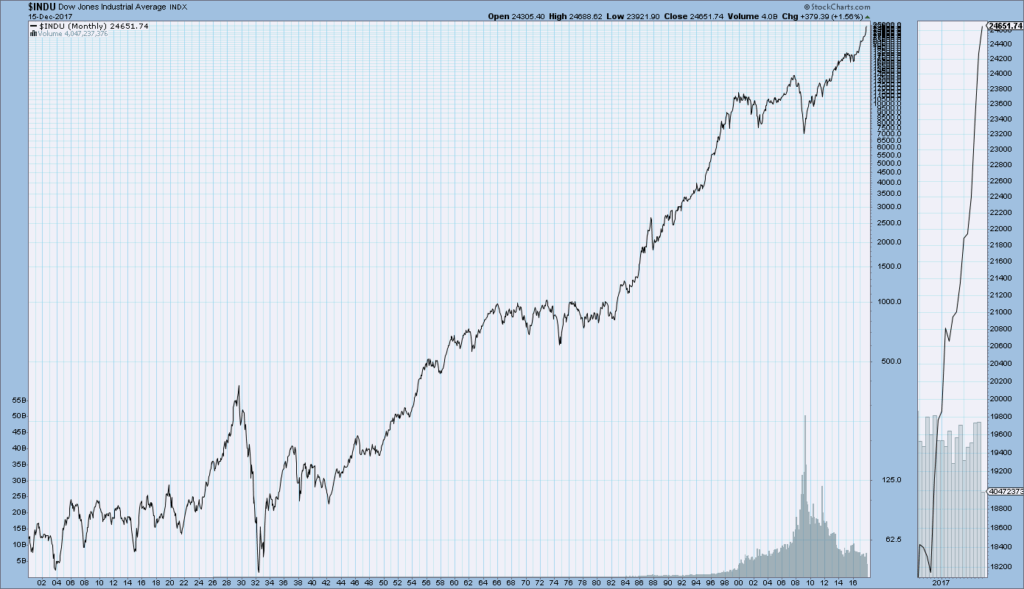

In the case of index funds, there is one major risk and it’s clearly reflected in the following graph.

Look familiar? This is the longer version of the graph from Step 1 of the Step-by-Step Guide to Investing Like a Pro. Here, however, it’s been extended to show the performance of the US stock market since 1900.

In fact, this is the Dow Jones Industrial Average, a different index from the S&P 500 that goes back further.

But it’s a similar concept in that this jagged little line gives a good indication of how the market has performed over time.

Overall, and as we’ve covered, those are some incredible gains.

However, it would be foolish not to acknowledge that there were some extremely rocky times in there.

You can easily see the sudden drops formed by the crashes of 1989 and 2008. And these pale in comparison to the Great Depression, in which the stock market lost 90% of its value.

That one took 25 years to recover to pre-Depression values. It makes the six-year recovery after the 2008 crash seem like a walk in the park.

But despite these significant blips, as you can see, the market always goes up.

That’s why it’s incredibly important to recognise that the biggest risk with index funds is you. Or, more specifically, your own nerve.

Because there will be crashes. And it will be very tempting to sell during a crash so as “not to lose more”.

The problem with that strategy is that the market will, eventually, start to climb again. And you’ll want to buy back in.

However, what happens in more cases than not is that buyers come back in too late and lose some of the gains that they could have had if they’d simply held.

This means that once the market recovers to the point that it was pre-crash, you’ll be worse off.

You may even wait until the market has climbed past its pre-crash point, “just to be sure”. This will result in you losing even more money.

That said, I fully acknowledge that this is easier said than done, especially with index funds that track the market as a whole.

For example, with an index fund that tracks the S&P 500, a 20% drop in the overall stock market will see a 20% drop in the value of the fund. Certainly not anything to sneeze at.

You wouldn’t necessarily see that with, for example, an actively managed fund that focuses on one particular sector of the economy. This is especially the case if that sector, for whatever reason, doesn’t experience the same devaluation as the rest of the market.

It can certainly be nerve wracking.

So it’s imperative in such situations to remember, once again, that the market always goes up.

Can you prove that “buy and hold” works?

Absolutely.

Recall how an index fund (or, indeed, any fund) works: let’s say that the price per unit of a fund is $100 and you invest $10,000. So you own 100 units.

Suddenly, it’s 2008 again and the S&P 500 loses 50% of its value. Your $10,000 is now worth $5,000. Crap.

But you still own the original 100 units. So when (and it’s always when) the market recovers, the value of your 100 units will go back up to – and likely surpass – the pre-crash levels.

Compare this to if you looked at the hysteria in the news during a crash and decided to sell to get out on the way down.

Say you sell your 100 units when the market has lost 25% of its value, so you get back $7,500. Everything calms down a bit and you decide to buy back in when the market has recovered to the exact level that it was pre-crash. That is, you spend $10,000 to get your 100 units back.

You’ve just locked in a $2,500 loss. And that loss only increases when you do what most people do and buy back in once the market has exceeded its pre-crash levels.

If only you’d just held (perhaps with a few stiff drinks to help you along the way), your portfolio would be thanking you for it.

Isn’t this easier said than done?

Couldn’t agree more.

I am, after all, a smug millennial. I didn’t start investing until after the 2008 recession and so I’ve only personally experienced what is currently the second-longest bull market in history.

It’s very nice to discuss the virtues of investing in index funds when I’ve only seen incredible gains throughout the time that I’ve been in the market.

I also fully acknowledge that it would be much, much harder to hold your nerve if you are a bit later in life and thus time may not be on your side to ride out the crash until the recovery. This is especially the case if you have reached retirement and are withdrawing 4% of your investments each year for your living expenses.

After all, 4% of your investments if your investments have dropped by 50% is a fairly substantial hit to your lifestyle.

This is why, as we’ll discuss later, there are steps you can take to reduce the risk when you are at that stage of your investing timeline. This primarily involves partly investing in some lower-risk options to soften the blow of any crash.

But if you’re still in the wealth-building stage of your life, as I am, then keeping as much of your money as you can in index funds that track the market is key to ensuring that your money is working for you as effectively as possible.

Then when the next crash comes, we’ll all collectively grit our teeth and chant together: buy and hold. Buy and hold.

A crash can be an opportunity

There’s a famous saying in personal finance circles: Time in the market is better than timing the market.

What this means is that you shouldn’t try to buy in when you think that the market is about to boom. Mainly because no one, despite what so-called experts will tell you, has any real idea what will happen next.

Instead, regular investments over a long-term period have been shown to be the best way to maximise your returns.

That said, it’s worth pointing out that a market crash can be an excellent opportunity for your overall portfolio.

Let’s use the same example of buying into an index fund as mentioned above.

You originally invested $10,000 into a fund that costs $100 per unit and thus ended up with 100 units.

After saving up an additional $10,000, you discover from the TV screeching hysterically at you that the market has actually devalued by 50%. Great news! Now each unit costs $50, meaning that you can buy a further 200 units.

When the market eventually recovers to the point that the fund price is back to $100 per unit, your portfolio of 300 units will be worth $30,000.

In other words, you’ve made $10,000 on your original investments. That’s a 50% rate of return. Not bad at all!

Especially considering that this is the natural course of the market after a dip, given that it always – eventually – corrects itself.

“But what if one day it doesn’t?” you ask.

If there’s ever a day when the market is completely wiped out forever and ever, it will literally be because there has been some sort of armageddon or zombie apocalypse. In which case, you’ll have bigger things to worry about than the value of your portfolio.

To clarify, this is absolutely not to say that you should want a market crash.

But another (and another and another) crash is inevitable. And while there are always some fairly horrendous effects from such events, this example should help to show that out of the flames of a financial inferno, opportunity often emerges.

Summary

So what have we learned today, kids?

- We must always remember, especially during bad times, that the market always goes up.

- Manage the potentially rocky road of an index fund by simply buying and holding.

- A market crash may be scary, but it’s also a great wealth-building opportunity.

- There are ways to mitigate the risk of a falling market. But we’ll get to those another time.

Read the entire Step-by-Step Guide to Investing Like a Pro here:

Step 1: The Beginners’ Guide To Investing Like An Expert (Including How To Beat The Professionals)

Step 2: How To Invest Your Money For The Best Returns (For The Least Amount Of Cost and Effort)

Step 3: How To Prepare For Risks To Your Investments – And Turn Them Into Rewards

Step 4: The Simplest Investment Portfolio You Will Ever Need

Step 5: Why Bonds May Save Your Life (Or At Least Your Portfolio)

Step 6: How To Build Your Very Own Expert Investment Portfolio