Black Friday. The very words strike fear into the hearts of budgeters everywhere. But, luckily for you, there’s a way to succeed at Black Friday on a budget.

We only need to look at previous years to see why it’s such a spending frenzy.

In 2016, for example, 154 million people shopped on Black Friday, spending approximately $290 per person. More than 108 million of these people shopped online.

That’s a lot of smoking hot credit cards.

Funnily enough, Black Friday didn’t get its name because it signified the death of any sort of savings plan.

While the term was originally used in 1951 in reference to the practice of workers calling in sick on the day after Thanksgiving, the shopping-related reference was first used in 1981.

This was because the day’s sales are so high, it can push a retailer from being “in the red” (or losing money) to being “in the black”.

Suffice to say, the day is built around separating you from as much of your money as possible.

Of course, there are deals to be had and so, in some cases, spending on Black Friday can, in fact, be a good thing for your finances.

But only if you can control yourself.

So before launching yourself into the internet brandishing your credit card, consider these tips for how to make sure that you don’t completely blow your budget.

1. Set a budget and stick to it

Your first priority should always be your savings. So make sure that you only spend what is left after saving, not save what is left after spending.

Next, truly consider how much you have to spend without going into debt.

You should not under any circumstances go into debt for the sake of a Black Friday sale.

Christmas is already an expensive time of year for many people. So don’t make things more difficult for yourself by tightening the financial screws even further by exceeding your budget.

Which leads us to the next point.

2. Only buy what you actually need

I got an email the other day about a “pre-Black Friday sale” of a certain handbag brand reduced by up to 75%.

Now, don’t get me wrong; these handbags are beautiful. As I scrolled through the images of women strolling down the street with their brand new bag strewn artfully over their shoulders or dangling enticingly from their forearm, it was hard not to admire this brand’s latest collection.

And then I deleted the email.

I don’t need one of these handbags. Sure, they’re pretty. But I have a perfectly good one for carrying my laptop to work and whatever other goodies I need.

So don’t be blinded by the beautiful pictures and what are apparently once-in-a-lifetime sales.

If you find that you’re saying to yourself, “Ahh, but maybe I do really need [insert object]”, then you probably don’t.

At the same time, Black Friday can be an excellent opportunity to get the things you truly do need.

For example, if any of my favourite, budget skincare is reduced, I’ll be stocking up.

If next year is the year that you’re absolutely definitely going to get fit (and why wouldn’t you when you can do it for free!), then maybe you should consider buying discounted running shoes and other exercise gear this weekend.

If your kids’ shoes are getting a bit tight, perhaps see if anything is on offer that will get them through the next 12 months or so.

Similarly, anything for the house that you can buy in bulk and that doesn’t go off is perfect to add to your shopping list.

RELATED ARTICLE: 21 THINGS TO BUY THAT WILL ACTUALLY SAVE YOU THOUSANDS OF DOLLARS

The best way to do this is to write out your ideal shopping list. Then check Amazon or your other online store of choice for the prices of everything. You can most likely do this in the days before Black Friday as stores like Amazon tend to list their discounted prices early.

Calculate the total cost and then compare this to your total available amount.

And then get aggressive. Start striking off things that will exceed your budget.

Anything that is a “want”, that won’t involve you ultimately saving money, or that can’t be bought at another time of the year for the same financial benefit should be removed.

Then comes the hardest part: stick to the list and the budget.

Don’t be tempted by, say, pictures of carefree women carrying beautiful handbags.

Buy what you need and run.

(Or whatever is the “close the tab” equivalent of running away from online stores…)

3. Use Black Friday as a way to save money for Christmas

There are plenty of ways to save money at Christmas!

Check out these articles in particular:

- 10 Hacks for Amazing Christmas Presents That Won’t Blow Your Budget

- 7 Easy Ways to Guarantee a Festive Yet Frugal Christmas Feast

- 4 Super Simple Ideas for Beautiful and Budget-Conscious Christmas Decorations

- 4 Rules to Follow for a Cheap and Cheerful Christmas

If you put some of these ideas into action now, you can easily start to save money this Black Friday!

For example, if you make the decision to have a price limit on each person’s present or to have a Secret Santa, meaning that you’ll only need to buy one present per person, then you know already exactly how many presents you need to buy and/or how much to spend.

Not only will you save money, but you’ll also save time!

Similarly, you could also start to look into some of these ideas for budget-friendly decorations this Black Friday.

For example, why not look into getting that artificial Christmas tree while it’s on sale?

(And while you’re in the process of trying to save money this Christmas, have a look at these 14 Proven Strategies For You To Make Money This Christmas)

4. Get cash back while you shop

I’m going to share with you a not-so-well kept secret: there are sites that will pay you to shop.

I. Know.

These sites allow you to earn points – which then convert into money – for every dollar you spend at eligible stores. The percentage of the purchase price which you get back as cash is usually around 5% to 10%, but some offer up to or even in excess of 40%!

And here’s a list of them just for you: 12 Ways For You To Make Money While Shopping (In No Time At All!)

So before you buy anything this Black Friday, make sure you sign up for at least one of these sites to make sure you’re getting money back on your spending.

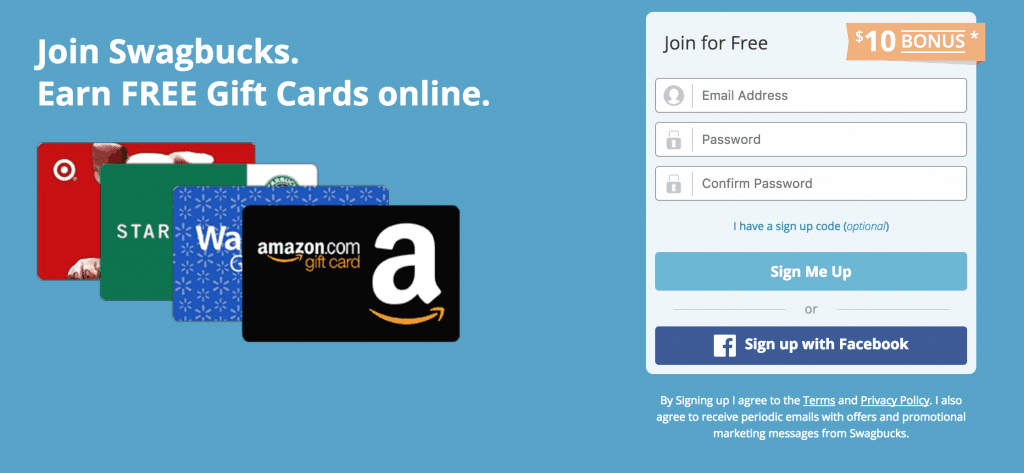

For me, I always make sure to use Swagbucks when doing my online shopping.

Signing up takes literally five seconds. And then all you have to do is login before you shop online at over 1,500 websites, including major ones where you’re probably planning to grab some Black Friday deals – like Amazon, Walmart and Target.

You then get back up to 10% of what you spend through gift cards for places like Amazon, Target, Starbucks and more.

(You can even get PayPal gift cards, which are exactly the same as getting cash.)

And better yet, you’ll get a $10 welcome bonus just for signing up here and verifying your email address!

5. Make sure that you’re actually getting a deal

This article raises something that you may want to consider:

A survey of major retailers found that more than half the deals on popular products during last year’s promotion were either the same, or better, months either side of the event. […]

The consumer group Which? looked at the prices for a 12 month period covering before, during and after Black Friday 2016 and found that 60 per cent were cheaper, or the same, at other times during the year.

[…]

Alex Neill, Which? managing director of home products and services, said: “Our research shows that although Black Friday can offer some great discounts, not all offers are as good as they seem.”

So do your research, including in the days prior to Black Friday, to see whether the AMAZING DEAL that you think you’re getting is actually as amazing as it seems.

6. Be careful of using credit cards

When used properly, credit cards can be a great way to manage your finances. The ability to earn frequent flyer points or even get cash back can all be really useful when you’re in wealth-building mode.

But this is only if you have the discipline to only use your credit card up to an amount that you can pay off each month.

If you are being charged interest on your credit card purchases, then any advantage is immediately wiped off the table.

It’s also worth repeating what I said above:

You should not under any circumstances go into debt for the sake of a Black Friday sale.

So if you are absolutely certain that you have the self-control to use your credit card responsibly, then by all means continue as you were.

But if you know, deep down, that you’re far too tempted by a sale, then perhaps only limit your online spending to a debit card that you’re not able to exceed.

Alternatively, if you’re planning to shop in-store, try taking only cash. That way, you have no choice but to only spend within your limit.

RELATED ARTICLE: 27 CREATIVE WAYS TO TRICK YOURSELF TO SAVE MONEY

7. Get your savings ready in the days leading up to Black Friday so you’re ready ahead of time to do Black Friday on a budget

This doesn’t only mean that you should do things like sign-up for Swagbucks ahead of time so you know how to use it once the Black Friday sales start, although that’s great as well.

But consider also signing up for the newsletters of your favourite stores. That way, you’ll hear about their deals as soon as possible – and may also get special subscriber-only deals too!

Similarly, if you’re planning on shopping with Amazon this Black Friday, it’s a great idea to sign up for Amazon Prime beforehand.

You’ll get free shipping and a ton of other great deals. Better yet, sign-up here and you get a FREE one month trial.

So feel free to use it during Black Friday and for your pre-Christmas purchases – and then cancel it before the trial period is finished, if you want!

Happy shopping! Let me know in the comments what amazing deal is on your list this Black Friday!