Welcome to Step 2 of our Step-by-Step Guide to Investing Like a Pro!

(Because “Investing for Dummies” sounded a bit harsh)

Before doing anything, make sure you read Step 1: The Beginners’ Guide To Investing Like An Expert (Including How To Beat The Professionals) to start seeing exactly why we recommend index funds as being the best investment strategy for making your money work for you.

In summary: it’s super easy, super cheap and is the method that has seen the best returns over time.

But knowledge is power! Especially when you’re making a decision as important as how to invest your money.

Accordingly, there are still some more things you should know.

How come I’ve never heard of an index fund?

Because why would any investment company (or financial advisor or broker or analyst or fund manager) want to advertise a low-cost, more effective option when they’re going to be paid less for doing so?

This hasn’t, however, stopped index funds from exploding in popularity.

As some history for you, the first index fund was launched by the founder of Vanguard, Jack Bogle, in 1976.

Ah, two little pings in that sentence! Remember when I told you in Step 1 to remember the names “Jack Bogle” and “Vanguard”? Don’t worry, they’ll pop up again shortly.

After only 40 years since the establishment of the first index fund, just over a third of all assets in the US are in passive funds (source). This is up from 20% of all assets only ten years ago. Vanguard alone holds around $4.5 trillion in global assets.

In only the first half of 2017, the value of funds that were transferred out of active funds and into passive funds reached nearly $500 billion. This immense increase has prompted Moody’s, the rating agency, to predict that passive investing will overtake active management in the US by 2024.

So index funds are no flash in the pan. In fact, they are leading an investment revolution.

And you really, really want to get on board.

Should I really be putting all of my eggs in one basket?

You should when that basket involves more diversification than you could ever do on your own!

What you have to keep in mind is that you’re not buying into “one fund” in the same way as you would be buying one stock in one company. You’re buying into a fund that gives you access to an entire portion of the market.

Let’s take the example of an index fund that tracks the entire US equity market, VTSAX. At the time of writing, it consists of stocks from 3,599 different companies across the following sectors:

Source: Vanguard

As you can see, this is an extremely broad range of categories. Investing in VTSAX essentially involves buying shares in companies across all of the major market sectors.

This is because, simply put, by buying VTSAX, you are actually buying a piece of every company that is traded on the US stock market.

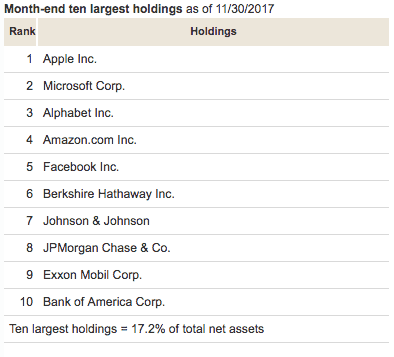

To provide an example of some of the companies that this includes, take a look at the list of the ten largest holdings in VTSAX at the time of writing:

Source: Vanguard

Evidently, these are some of the biggest companies in the world. You may also remember them from Step 1 as forming the top companies by weight of the S&P 500.

And instead of the cost and risk of buying shares in each one individually, you could immediately own a portion of all of them by investing through an index fund like VTSAX.

What if a company goes bankrupt?

Investing in index funds significantly reduces the risk that is faced by those who hold individual shares. Specifically, the major risk of a company’s share price crashing or a company going bankrupt.

If you hold stocks in a company and it goes bankrupt, you’re screwed. Wave goodbye to your money.

Similarly, if the share price crashes, you may be in for a world of pain. Whether or not the share price recovers to the value at which you bought your stocks is far from a sure thing.

If you’re part of an actively managed fund that has one such company in its pool, you won’t lose all your money. However, given that the pool will more than likely not include more than 3,500 different companies, the overall price will probably drop and you will find yourself with far lower returns than hoped.

However, you’re in for a far better time if this happens when you’ve invested in an index fund. In such cases, the company simply drops out of the list and is replaced by one that is doing better. That is, the poorly performing company doesn’t drag down the total price and you won’t lose all of your money.

So sure, an index fund may be one basket. But it’s a basket consisting of thousands of portions across every sector of the economy.

It would be pretty hard to find something more diversified than that.

Especially when the ideal way to benefit from this basket is to simply place your eggs in there, leave them in peace until you retire, and then withdraw as needed to last you forever.

But how can something so simple be the best investment strategy?

Well, why not?

Any complications you add to any strategy will also add expense. Which, as we’ve seen, cuts into your returns.

It’s also been well-established, as seen through the figures in Step 1 of the Step-by-Step Guide to Investing Like a Pro, that adding complications – such as through having a fund manager playing around with your money – far from guarantees better returns. If anything, it’s the opposite.

All of that said, nothing in what I’ve explained in this Guide should be interpreted as if I’m promoting index funds because they’re simple.

That part’s just icing on the cake!

Instead, index funds are the best investment strategy because they consistently have the best returns over time.

The more effectively my money works for me, the less time I have before reaching financial freedom.

And I’m extremely impatient. I don’t want to wait any longer for something that I want than I have to.

So if an index fund is the best place to park my money in order to maximise my returns without considerable long-term risk, meaning that it provides the best opportunity for me to retire early – then I’m all in.

Index funds have been accused of being “investing for lazy people” or for “people who aren’t smart enough to pick their own shares”.

Well, joke’s on them. Because at the end of the day, you’ll have more money in less time.

And if it happens to have taken the least amount of effort necessary? Well, what a terrible side effect, sign me up!

Of course, no investment is ever completely risk-free. Even keeping your money under your mattress will result in it losing value due to inflation.

So read on for Step 3: How To Prepare For Risks To Your Investments – And Turn Them Into Rewards

Read the entire Step-by-Step Guide to Investing Like a Pro here:

Step 1: The Beginners’ Guide To Investing Like An Expert (Including How To Beat The Professionals)

Step 2: How To Invest Your Money For The Best Returns (For The Least Amount Of Cost and Effort)

Step 3: How To Prepare For Risks To Your Investments – And Turn Them Into Rewards

Step 4: The Simplest Investment Portfolio You Will Ever Need

Step 5: Why Bonds May Save Your Life (Or At Least Your Portfolio)

Step 6: How To Build Your Very Own Expert Investment Portfolio