Today, we’re going to talk about that shiny third limb that pretty much all of us have: our phones.

And the fact that you’re probably pouring way too much money into yours.

Don’t worry, I’m not going to suggest that you should get rid of your phone or downgrade to a brick Nokia 3310 to save money. After all, my Samsung is probably one of the first things I’d grab in a fire.

(To call the fire department. Not to post a photo of the fire on Instagram.)

But there’s absolutely no reason that anyone should be spending huge amounts of money on their phones.

Despite this, almost half of all cell phone users in the US spend $100 per month or more on their phones and another 13% pay at least $200 per month (source).

That’s between $1,200 to $2,400 per year on your phone. Even a more “reasonable” cell phone plan of, say $70 per month equates to $840 per year, which is not a small amount of money.

It’s all well and good to cut coupons to save $0.20 on washing detergent or to buy a generic brand of milk to save $0.40 per litre.

But the real way to save serious money is to look at your major expenses and see how they can be massively reduced, if not eliminated.

While we can’t totally eliminate cell phone costs, unless you want to go live in a cave (you do you!), there are ways to significantly cut them back.

And just by putting into practice the tips in this article, you could easily save at least $1,000 each year depending on how much you’re paying now for your cell phone.

Which isn’t a bad saving for less than an hour of work!

Check out these related posts:

- How To Make Money Cleaning Out Your Old Stuff

- 9 of the Best Survey Sites to Make You Money Online

- 27 Ways To Trick Yourself To Save Money

- How To Refinance Your Student Loans In Two Minutes and Save Thousands

Check your actual usage

Often we get sucked in to getting the unlimited plan – or at least a plan with a huge amount of data/minutes/etc. – because “what happens if I run out of data/minutes/etc. before the end of the month”.

But have you ever checked to see if you’re even close to that happening?

For example, you may be paying for a plan with 1,000 text messages per month, despite the fact that you use WhatsApp and so rarely ever send an SMS these days.

Or you may be paying for 10GB of data per month, but you have WiFi at home and WiFi at work. Do you even come close to using all of that?

It’s not even necessary to have hours of calls on your phone plans anymore with the existence of FaceTime, Skype etc.

So take a look at your average phone use over the last few months compared to what you’re paying for to see if you’re overspending.

Chances are that you are. And if so, it’s time to do something about it to stop throwing away hundreds, if not thousands, of dollars per year.

Do you really need insurance?

This often comes bundled as a “great deal” with your phone plan. For only about $10 extra per month, you can rest easy knowing that you’ll be fine if something happens to your phone.

Well, almost. Let’s consider the figures for the iPhone X.

For example, according to this site, AT&T has the cheapest protection plan out of the major US carriers at $9 per month. But they charge $299 for a claim.

This means that if you pay for 24 months of protection (= $216) and make one claim in that time, it will cost you $515.

That’s almost half the cost of the original phone! And it only covers accidental damage, not theft.

Even purchasing AppleCare directly from Apple for your new iPhone X will cost you $199 for two years of coverage plus $99 for a claim. That’s $298 that, again, doesn’t cover theft.

These costs are massive (ignoring the question of whether you really need a $1,000+ phone), especially for something that you may not even use and, if you do, it’s questionable whether it’s even worth it.

One great trick for figuring out if you even need insurance is to ask yourself whether the potential loss would have catastrophic financial implications for you.

For example (incoming hot topic, US readers!), health insurance is critical given the potential cost of a major unexpected illness. Similarly, it’s clearly important to have property insurance over your house as if it burnt down, the financial loss would clearly be enormous.

On the other hand, losing your phone or accidentally damaging it so that it’s unusable would be a complete pain in the butt. Don’t get me wrong, I’d be absolutely pissed if someone stole $1,000 from me.

However, it wouldn’t be the end of the world from a financial perspective. It would be annoying and I’d be upset that I’d be wasting money that could have been better spent elsewhere. But it would hardly leave me homeless.

So if you’re currently paying for phone insurance, look at exactly how much it’s costing you over the life of your contract. Then ask yourself whether the cost of having to replace the phone yourself is really worth forking out as much as you are. I strongly suspect that the answer will be no.

Change to a better deal

When you’re already with a specific phone provider, it can be very easy to simply stick with them when you’re up for a renewal.

After all, you know they work and changing your provider is such a hassle…isn’t it?

Well, actually, not at all. Especially when you consider that putting in a tiny bit of effort to change providers can literally save you hundreds or even thousands of dollars each year.

The major providers have a lot of flashy advertising that make it seem like they’re the best option. But that’s not necessarily true in terms of phone coverage and it’s ABSOLUTELY not true in terms of your finances.

Instead, I like to shop around the smaller providers. They’re regularly cheaper and often use a network of one of the major providers, so you get the same phone service for a fraction of the cost.

And the one that I’ve found to consistently offer the best deal in terms of price and service is Republic Wireless.

For starters, you’re not on a contract with them so you’re not locked in for any period of time.

But best of all, the prices are amazing. They start at $15 per month for unlimited talk and text and then $5 per month for each GB of 4G data you use.

You can even change the amount of data each month you pay for depending on your usage. For example, you could set it up to only pay for 1GB per month, meaning that you’d only pay a monthly rate of only $20.

However, if you find that you’ve run out in the middle of a month, you can easily pay for an extra 1GB and then drop back to the usual amount next month.

This then absolutely addresses the first point raised in this article: you shouldn’t be paying for phone services that you’re not using.

But how is Republic Wireless so cheap?

It’s because the network is based on calls being made over WiFi. If you’re connected to a WiFi network, your phone will automatically default to making a call using that.

That doesn’t mean that it won’t work if there’s no WiFi available! If the connection is weak, your phone will use both WiFi and cell service together to make sure the quality is good enough. And if there’s no WiFi at all, it will work just like a regular phone.

This isn’t to say that you have to tell your phone to switch to one option if another is available – even if one option drops out mid-call, your phone will switch to the one with the stronger connection automatically.

The fact that calls are made over WiFi also means that you can use it for free overseas! And the company helps you to transfer your existing number to them, so there are no issues on that front either.

They’re definitely an option that I’d recommend you to look into. If you’re part of the majority of people paying at least $100 per month for your phone, this could represent a saving of almost $1,000 a year.

You can find out more information on Republic Wireless here.

Check the actual cost before upgrading to a new phone

It’s not really breaking news to say that one of the most expensive parts of using a cell phone is actually buying it in the first place.

I always prefer to buy mine outright as it’s consistently cheaper than doing it through a contract.

Firstly, it means that I’m not locked in to one provider, so can shop around for the best deals for my actual phone service.

Secondly, phone providers are sneaky when offering you an upgrade.

After all, they may say that they’re willing to extend the “great deal” that you’re getting on your phone plan – and will even throw in a brand new phone for only $20 extra per month! What a deal!

Eh, probably not. For one thing, you’re more than likely already overpaying for the original contract (especially if you’re not using everything that it offers – see above!)

But also, $20 extra per month equals $480 per year. Depending on the phone you get, that may be close to the cost of buying it outright.

And even if it’s not, the saving you’re getting of “buying” the phone for this reduced price is almost certainly eaten up by the inflated cost of the contract.

Think of it this way: say you get a phone for $20 per month on a 24 month contract that would have cost you $200 extra in total to buy outright. So you’re paying $480 over two years instead of $680. Great!

But then your contract costs $30 extra per month than what you would pay for using a cheaper provider, like the one mentioned above. On a two year contract, that’s an extra $720 in phone bills.

This would mean that you’d be out of pocket by more than $500.

Of course, this depends on which phone you get and the cost of your contract. But, in my experience, it has always been cheaper to buy my own phone outright and then have the flexibility to shop around for the best deal for the provider.

…and do you even need a new phone?

The other problem with these upgrades is that they convince you that you need to replace your two year old phone.

But do you really? My 2.5 year old Samsung is working perfectly fine. And sure, several new models have been released in the last few years with a slightly bigger screen and marginally better camera quality.

Just to clarify, I love playing with new tech toys. My sister got a new phone a little while ago and threw it at me when she got home, saying: “Can you set it up for me? I know you love doing it, you weirdo.”

She’s right, I totally do.

And if you’re the same, that’s fine (weirdos unite!). But this doesn’t mean that you need to get sucked into this artificial buying cycle.

In my case, I had my previous HTC for four years. Only when it slowed way down and started to have trouble being compatible with new updates did I start to look around for a new one.

So just because your phone provider is offering you an upgrade or just because there’s a new phone with an extra 0.25 of an inch of screen space doesn’t mean that you need to get rid of your existing one.

Consider what you really need first and then see if the expense is actually worth it.

What if I actually do need a new phone?

Then shop around like the savvy saver you are!

In addition to the point above about buying phones outright, it’s no surprise that looking at online stores will probably get you the best deal in the end.

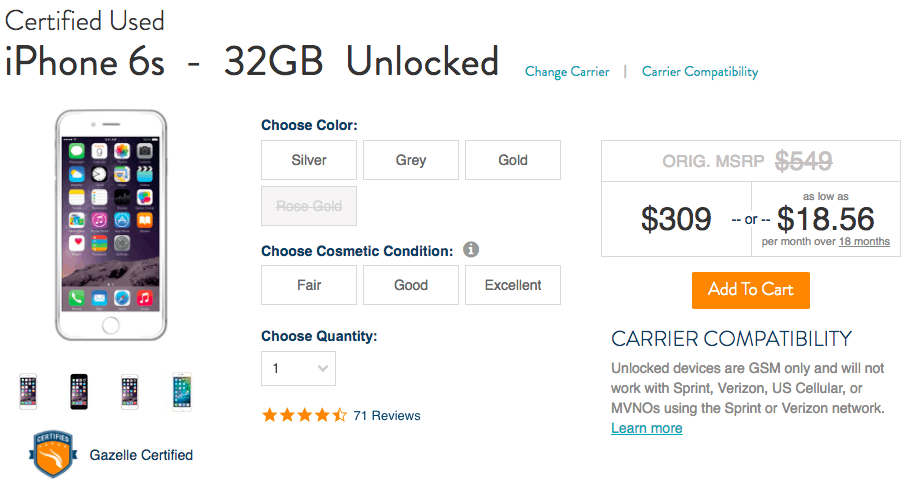

You could even consider buying a used phone. For example, Gazelle sells a range of refurbished phones that work perfectly well at a fraction of the cost of a new one.

You can see below that an unlocked 32GB iPhone 7 costs $469, which is $180 less than it cost new just over one year ago.

And if you want to save even more, an unlocked 32GB iPhone 6S goes for $309. That’s a saving of $240.

However, my favourite service offered by Gazelle is that they pay you to trade in your old phone. You’ll usually get a few hundred dollars for it, depending on how old the model is.

However, my favourite service offered by Gazelle is that they pay you to trade in your old phone. You’ll usually get a few hundred dollars for it, depending on how old the model is.

While this is more than likely less than what you paid for the phone originally, it’s more than you’d get for leaving it gathering dust in a drawer.

All you have to do is go to Gazelle’s website, select your phone model and you’ll immediately get an offer. You then post your phone to them for free and your money will be on its way once they receive your package. Super easy. And great for offsetting some of the cost of your new phone!